Sand Spring Advisors LLC

The scales of the two charts above are somewhat different, but we believe that stalwart stock GE -- voted the number #1 most admired corporation by Time magazine last year -- is set for a significant and steady tumble. It will thereby join Time's #2 and #4 most highly regarded corporations of 2000 Cisco and Intel already in the sewer. (The #3 most highly regarded corporation is Microsoft, currently half the way to the sewer).

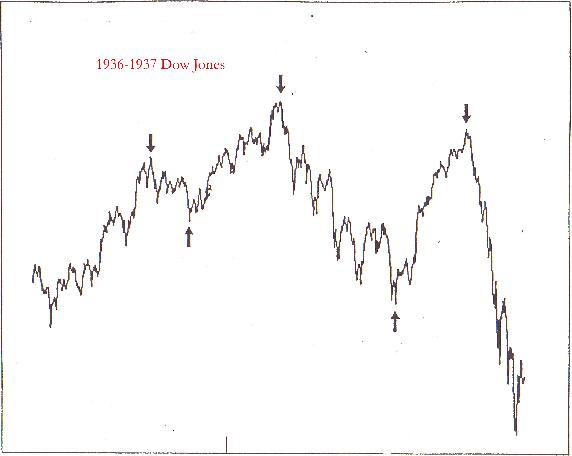

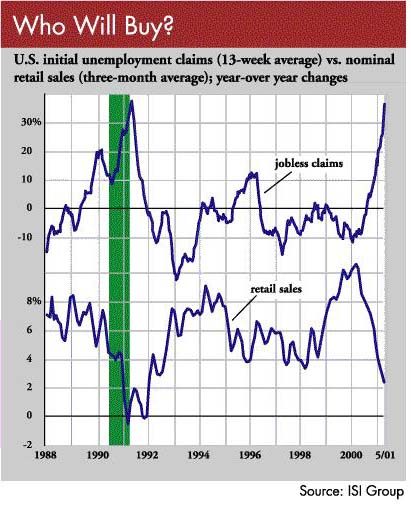

This move will be indicative of a strong recessionary wave about to finally hit home on the average American. The consumer is already tapped out per the recent behavior of retail sales shown below, and unemployment is shooting higher. This will be a deadly combination for the average over-leveraged American.

And GE -- part consumer-oriented company, part manufacturing bohemoth, part leveraged finance company (cum hedge-fund) is going to finally fall from grace.

With time, we see prior support in the mid-30's for GE giving way to a $25 target.

All of this will likely cause a temporary flight into fixed income. Whether this is justified or not longer term, we doubt, but we would not want to fight that market for now.

Gold has recently shot its bolt in typical late-cycle fashion as the very last equity group to rally...and looks to now be failing miserably. Longer term, we'll eventually get back into the metals once again since stagflationary pressures truly exist, but for now sell your GE, and buy 3-year notes (or better yet, buy a solid non-directional fund of funds). If going short GE, work with stops set above $56.

All this looks likely to get quite ugly quite fast.

All contents are Copyright © 2001 by Sand Spring Advisors, LLC, Morristown, NJ

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ