The Chart du Jour

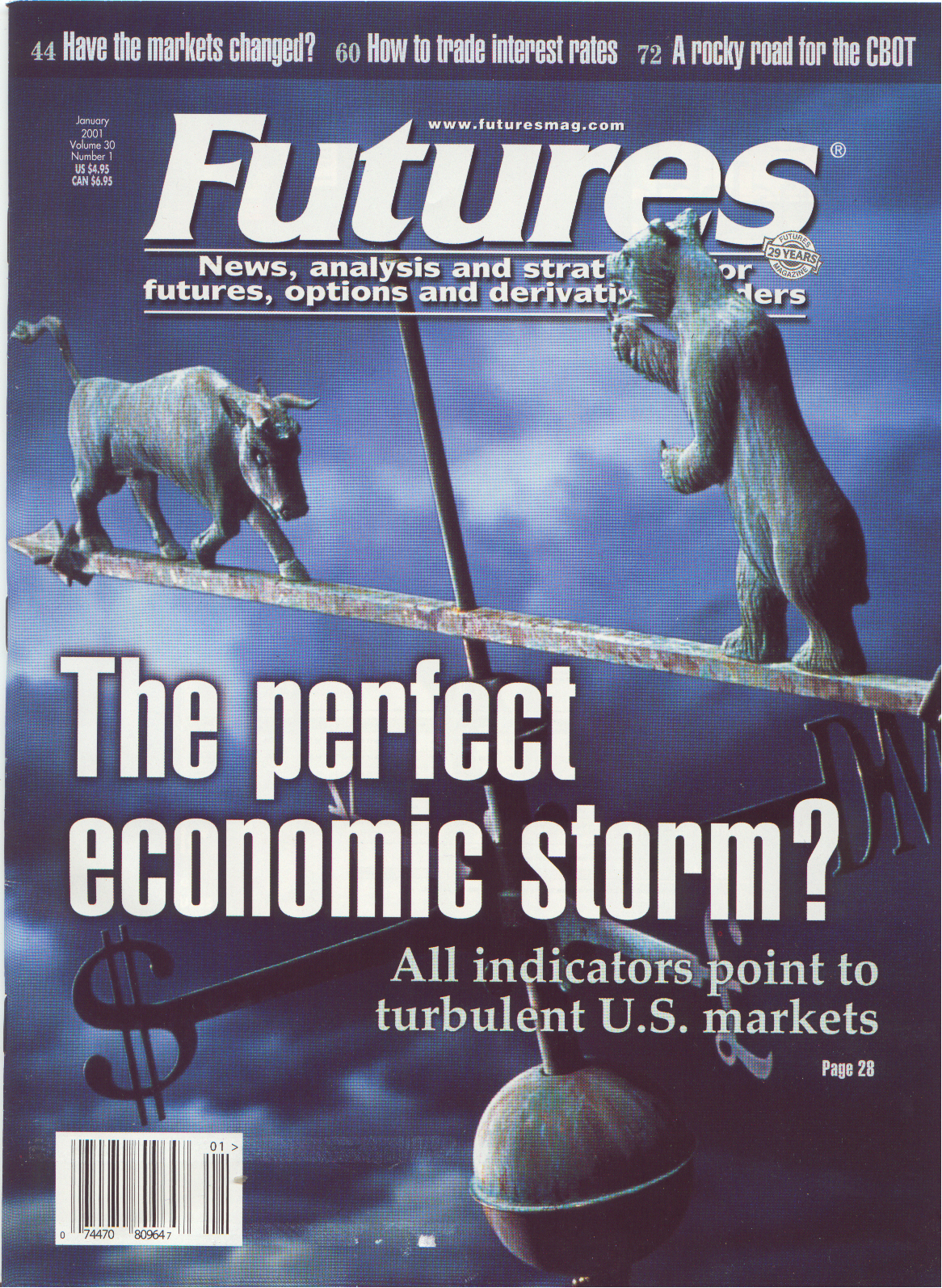

Upon our return from vacation, we received a copy of Futures Magazine in our mailbox with the gloomy cover above querying whether the U.S. markets were about to enter "the perfect economic storm?" We have long felt that Futures Magazine -- while useful for selected articles -- invariably publishes "macro-oriented" articles (together with related magazine covers) that appear at exactly the wrong time with exactly the wrong message. We have previously commented upon this -- speaking mostly with regard to the U.S. dollar's strength -- back in September.

Then BINGO. No sooner has this Futures edition arrived, than the Fed offers the market a gratuitous interest rate cut. The real message of the Futures cover should of course have been interpretated in a contrarian fashion: "Don't worry, be happy" -- at least in the short term. And while the first week of 2001 may have indeed brought some wild volitility and "turbulent U.S. markets" to use the words of Futures, one must wonder whether in contrarian fashion, we should not expect the first quarter of 2001 as a whole to bring a period of gestation, recovery, range-trading.

A Fed rate cut will not of course be a cure-all for last year's equity bubble collapse. Instead, it is likely to act as a short term band-aid, but little else. We'd look for a few months where the Nasdaq gestates in a range that will be relatively quiet in comparison to last year, while the DJIA may creep to new highs. What was a dangerous broadening formation in the Dow, now increasingly looks like a continuation pattern to the upside, and we will shortly offer subscribers our Fibonacci vision as to where a final upside assault could lead.

Today's Fed rate cut is also likely to be the first step toward a firmer gold market, as the market questions how inflation-vigilent the Fed truly remains. Greenspan has now overtly reacted to a weak equity market more than anything else. He basically 'blinked' far earlier than others such as Paul Volker ever would have. If the gold market is alive at all, it should take him to task for his actions. Stagflation may yet be a word this generation of Wall Street neophytes will soon learn.

For immediate web-based access to our latest subscriber-only December 20th analysis, please support Sand Spring Advisors and purchase a quarterly subscription below. Our latest work will be accessible on the final page of the order process. A user-id and password for web access to all past and future articles will follow by e-mail.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ