The Chart du Jour

The Magic of Disney?

No, Nasdaq Hourly: 5-Waves Down and II Wave Bounce

Some people may breathe a sigh of relief Monday. There was no further meltdown in stocks, consumer confidence came in at a 32-year new high, Clinton told us the budget deficit will be gone by 2013, and Disney rebounded from the dead.

To those people, I say, "hold on - not quite so fast."

Yes, stocks held in there temporarily amidst the outdoor tempest of snow, but not before the Nasdaq 100 succeeded in scratching out a "5-waves down" structure on the 60-minute chart labeled below.

5-waves down is good for the bear case. A sharp a-b-c II wave up (the A wave having started late Tuesday) is normal. Tuesday's rally is likely to peter out as the week transpires somewhere around the the red line -- the 200-hour moving average -- before we turn south once again.

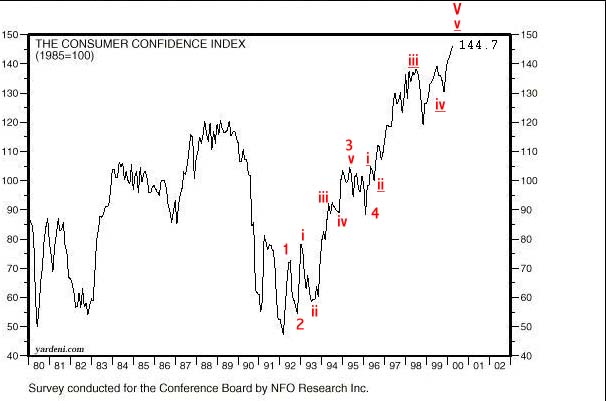

As for consumer confidence coming in at 32-year highs, please note that we just broke levels made the week of October 20, 1968 -- a horrific time to have bought stocks, just weeks ahead of a DJIA high Dec 2, 1968 that would stand for over five years in nominal terms, and that would stand for more than 20 years in inflation-adjusted terms. In addition, while the chart below of the Conference Board's Consumer Confidence Index only goes back to 1980, do we spy a 5th. wave from the 1991 low in progress? It is perhaps premature to say for sure, but confidence readings at these levels spell more trouble to us on a contrarian basis than they necessarily offer any bullish portent.

As for Mr. Clinton's 2013 balanced budget prognostication, anyone who really believes that forecast also probably believed every word from Mr. Clinton until Monica finally produced her favorite blue dress. We harken back to one of our favorite quotes, "With ease investors believe what pleases," but can anyone realistically put any credence in such a forecast? We don't.

And what of Disney? We never particularly care to say anything nasty about the world of Minnie and Mickey, but Disney peaked all the way back in May 1998 -- even ahead of the then historic July 1998 high in the broader indices. To quote from Bob Prechter's fine text Socionomics:

The Walt Disney Company released its first feature-length cartoon in 1937, the year of the top of a roaring five-year bull market that accomplished the fasted 370% gain in U.S. stocks ever. [Such] films stayed popular for thirty years, culminating with the ultra-sunny Mary Poppins in 1964, and to a lesser degree, The Jungle Book in 1967. The end of this period of success was essentially coincident with the great stock market top...[and] for the next sixteen years, as stock prices fell along with social mood, most people thought Disney feature films were silly and sentimental. Indeed, studio productivity fell by more than 50%. When the bull market returned in the 1980s and 1990s, so did feature-length Disney cartoons that have been acknowledged classics and box-office blockbusters...In the briefest possible terms, Disney cartoons are bull market movies, reflecting the shared mood of both their creators and their viewers.

Now unless you think that the upcoming Tigger Movie is going to replicate the success of The Lion King, we would view the current re-release of Fantasia as Fantasia 2000 as a failed effort to replay bull market times. (See the attached somewhat mediocre review.) Indeed, just visit the Disney website and view the "bloatware" that they have programmed for visitors. It takes so long to download that the kids are already snoring. Sorry, but Disney stock is already passe, and as such, we find just a bit more anecdotal evidence that this bull market is indeed on its final legs.

Am I wrong about this? Please post your comments in the Sandspring.com chatroom.

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973-829-1962, FAX your request to 973-829-1962, or e-mail us at

info@sandspring.com| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 1999 by Sand Spring Advisors, LLC, Morristown, NJ