The Chart du Jour

But instead of commenting on the chart of AOL, or on a broader equity market that continues to flail very much out of control (something that our previous Chart du Jours have already done in some detail, and upon which our vision remains very much unchanged at least until the S&P has reached the 1274-1280 range), we thought we would just mention the 4-day "coil" pattern that we spy in cash gold. A "coil" pattern is defined as a successive series of "inside days" with tighter and tighter ranges each fully contained within the last. The chart of Comex April gold is not as clean in this regard as the chart of the cash market below, and while we do not know which way this pattern will break, this market has clearly reached an important juncture. A break higher from this position would allow for a swift move up to $350, whereas a break lower will condemn gold to wallow in the mud of its $252-$295 range with a continued near-term negative bias.

Clues as to which way gold may break abound, but they are not definitive. The silver chart (not pictured) continues to look very defensive and negative, while the chart of Homestake Mining below looks nicely poised to come back from the dead (at least at some point soon).

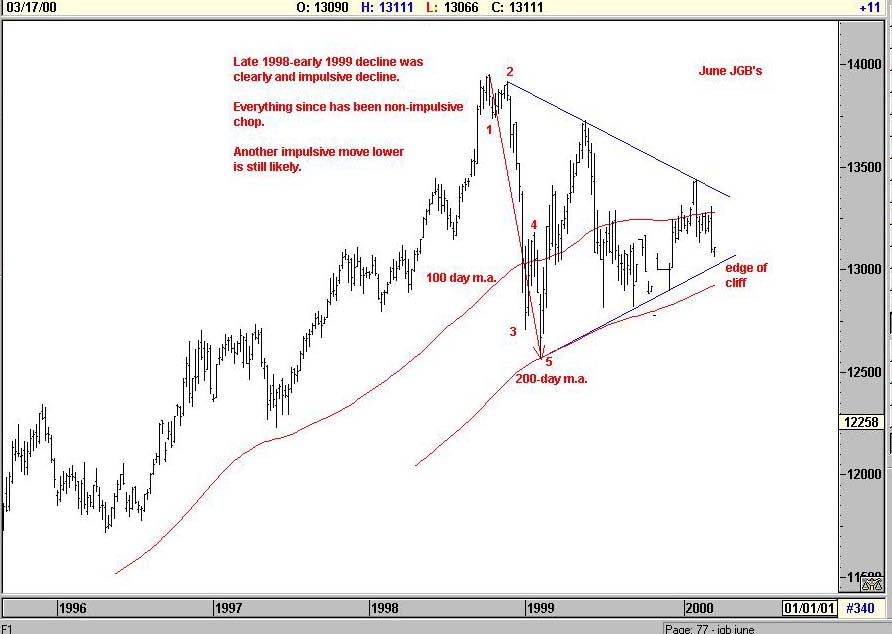

Perhaps the biggest sign of potential stagflation, and insipient inflation, continues to be the chart of Japanese Government Bonds (JGBs). This market hasn't done much for the last few months, but the look of the chart below suggests to us another leg lower soon.

On Monday the Japanese authorities announced poor economic figures -- officially throwing their economy back under the label of "ongoing recession." Yet the JGB bounce was anemic. The Japanese simply have so much debt to issue that their government bond market is unable to rally. Instead that market hangs precariously on the edge of a cliff.

Now give us Japanese stocks, bonds, and maybe even their currency (someday over the rainbow) all going down together, and we will give you a healthier gold market -- at least to $350. The first clue to watch as this potential situation plays itself out is how we resolve the 4-day coil in gold above. Resolve it to the topside now, then the odds will sharply increase for an ongoing rally starting now and lasting into early May. Break to the downside now, then we will likely continue to experience gold purgatory at least until May. On a marginal basis, we favor the former path, but as disappointing as the gold market has tended to be for the last seventeen years, it is best to let this market speak for itself in lieu of anticipating too much. One thing we do know: if gold does break higher now, we wouldn't wait very long to pick up some Homestake. What's the definition of cheap?

Please support Sand Spring Advisors and purchase one of our more in-depth articles below.

What our Subscription Only Articles Contain

We recently finished two in-depth articles on the equity world, one looking at some of the psychological signs of a mania entitled "A Certain Fixation," and the other focusing specifically on the Nasdaq. The former article discusses two specific equity situations, while the latter article examines the Elliott wave pattern of the Nasdaq's Price-Earnings Ratio since 1995, as well as various analog pattern matches involving the Nasdaq. "Nasdaq Crash and First Stopping Point" also looks at mutual fund cash levels, mutual fund positioning, and changes in the monetary base. It sketches out a possible path for the Nasdaq that may prove a valuable "roadmap" for trading over the balance of the year. Both articles offer some powerful evidence that a crash scenario is most certainly possible and perhaps closer than most realize. The articles are available for purchase below via credit card at $25 apiece. One may also subscribe on a quarterly basis to ALL articles past and present for just $65.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.>

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ