The Chart du Jour

Paul Montgomery of Universal Economics has long been the leader in interpreting the significance of magazine covers in major popular magazines as a contrarian sign that the trend depicted is about to change. Put Jeff Bezos on the cover of Time and it's probably time to sell Amazon; put Alan Greenspan "trapped" within a bubble on the cover of the Economist back on October 1, 1999, and the bubble is sure to just continue expanding; picture the world awash in oil as the Economist did in late 1998, and oil is most likely set to launch the rally of all rallies.

So it is that we note that the venerable New York Times chose to devote its Sunday, March 12th Money & Business section headline to "The Metamorphosis of Germany Inc." Pictured was a young blond-headed executive talking on a cell-phone pushing aside a heavy-set German dressed in a green felt coat, niederhossen, and other traditional Bavarian garb. The article spoke of the dismantling of post-war bureaucracies and the tax-free unwinding of $100 billion in corporate equity cross-holdings -- the effective "unravelling of Germany's corporate safety net" and a "frenzy of mergers, acquisitions and spinoffs" across Europe.

Fundamentally we, like most analysts, certainly view the German government's radical tax plan to allow corporations to shed cross-holdings tax free as a positive proposal. Germany needs to somehow avoid the morass of problems cross-holdings have caused in countries such as Japan in recent years. They need to put more equity shareholding in the hands of their companies' employees and the public, and by doing so, help to guarantee that German corporations will be more dynamic, efficient, and accountable than they have been in the past.

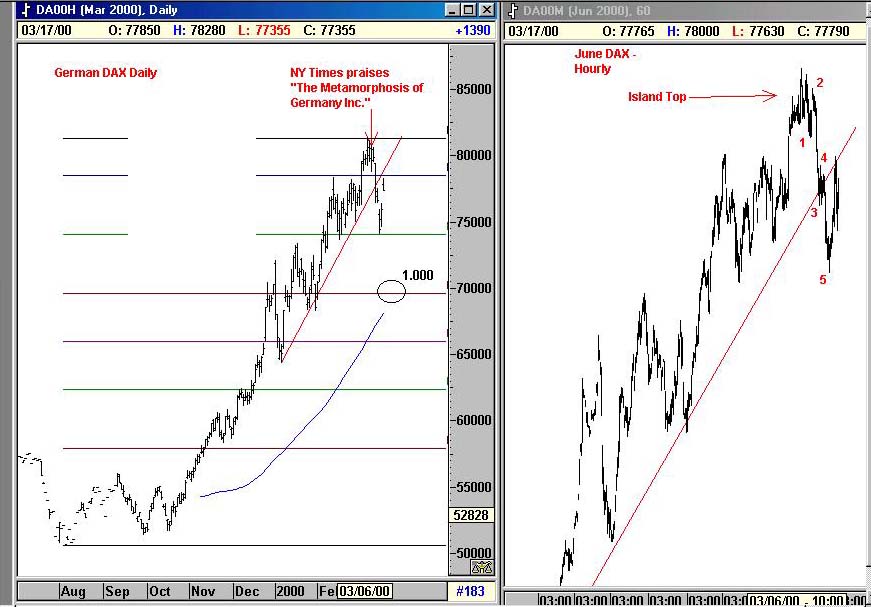

But we also find it ironic that the New York Times chose March 12th to publish such an article -- right at the top of the DAX and directly before the 5-wave descent that has since transpired! Because the descent in the DAX took a 5-wave form last week, the rules of Elliott wave analysis tell us that this decline cannot have been the entirety of the move. At best, it is only the first part of it -- either an A-Wave of an A-B-C corrective period or a potentially more serious 1-Wave down (we can't be sure which), but NOT a completed correction. We picture below the daily June Dax futures chart both on a daily and hourly basis to show you what we are talking about.

So Germany may well be entering a period of "metamorphosis," but the price action of the DAX does not suggest that this is the time to jump in and grab a slice of the new equity pie. It suggests instead a more protracted and deeper move lower first -- at least to the circled 7000 support area near the 200-day moving average. This would represent a full 38.2% retracement of the August 1999- March 2000 advance.

So read newspapers and magazines to keep abreast of global news, but be aware that the news they offer may only represent a rear-view mirror -- not a good investing opportunity. Newspapers tell us what has already happened, not what will. The DAX is far more vulnerable than the New York Times by itself would lead you to believe.

Please support Sand Spring Advisors and purchase one of our more in-depth articles below.

What our Subscription Only Articles Contain

We recently finished two in-depth articles on the equity world, one looking at some of the psychological signs of a mania entitled "A Certain Fixation," and the other focusing specifically on the Nasdaq. The former article discusses two specific equity situations, while the latter article examines the Elliott wave pattern of the Nasdaq's Price-Earnings Ratio since 1995, as well as various analog pattern matches involving the Nasdaq. "Nasdaq Crash and First Stopping Point" also looks at mutual fund cash levels, mutual fund positioning, and changes in the monetary base. It sketches out a possible path for the Nasdaq that may prove a valuable "roadmap" for trading over the balance of the year. Both articles offer some powerful evidence that a crash scenario is most certainly possible and perhaps closer than most realize. The articles are available for purchase below via credit card at $25 apiece. One may also subscribe on a quarterly basis to ALL articles past and present for just $65.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.>

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ