The Chart du Jour

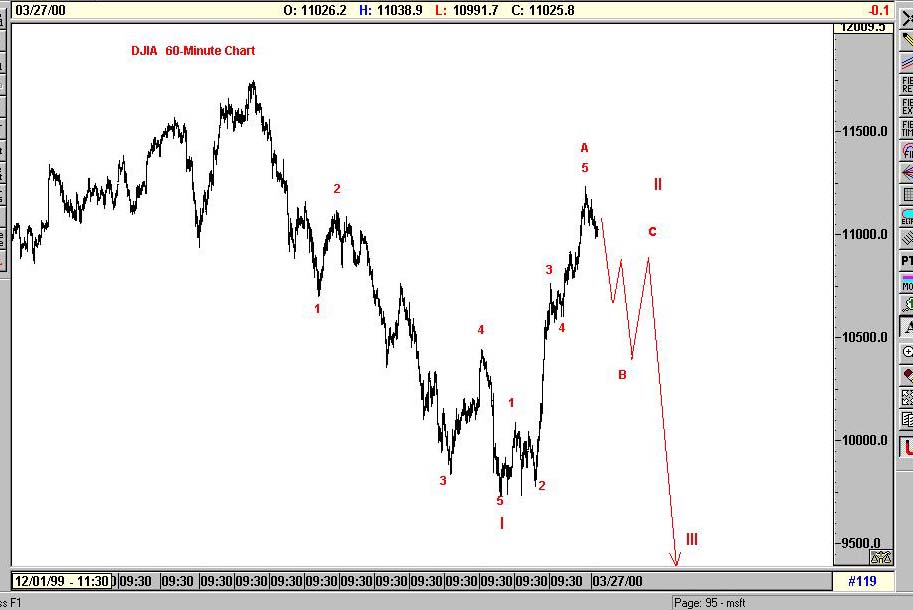

There is no denying that the recent advance of the DJIA has taken place in a five-wave format. If this is the beginning of a new impulse wave to the topside, bulls would argue that this is a Wave 1 of V, and that after a Wave 2 retracement, we will be off to the races once again.

Our view however -- taking into account some of our prior analysis in "A Thirteenth Century Mathematician and the Current Rhythm of the DJIA" and "Three Peeks and a Domed House - Revisted" (see Earlier Articles) -- is that we are most likely completing the A Wave of a more complex A-B-C 2 Wave corrective rally. As we suggested in our Chart du Jour of March 22, the Dow has bought itself some time, but probably little more. We have sketched out in the chart below a possible Elliott wave path from here. The definitive evidence that our count is correct as opposed to the more bullish one referred to above will of course not come until after the upcoming B-C part of the 2-wave rally is finished, and we see more impulsive downside price action once again.

We also offer today, the following Fibonacci Cycle time chart basis the S&P. Measuring from low to low, the rhythm here suggests to us that May 18 should be another low. Such a date would leave the minor lows of January 6th and February 28th as .382 and .618 respectively of time measured back to the October 18, 1999 low. May 4-5th is of course also a period of some cycle importance as well (see December Cycle Report), and because of this, we could envision building to a "crash like" environment by that time such that May 18th. would still be late enough afterwards to represent a tradeable low.

Please support Sand Spring Advisors and purchase one of our more in-depth articles below.

What our Subscription Only Articles Contain

We recently finished two in-depth articles on the equity world, one looking at some of the psychological signs of a mania entitled "A Certain Fixation," and the other focusing specifically on the Nasdaq. The former article discusses two specific equity situations, while the latter article examines the Elliott wave pattern of the Nasdaq's Price-Earnings Ratio since 1995, as well as various analog pattern matches involving the Nasdaq. "Nasdaq Crash and First Stopping Point" also looks at mutual fund cash levels, mutual fund positioning, and changes in the monetary base. It sketches out a possible path for the Nasdaq that may prove a valuable "roadmap" for trading over the balance of the year. Both articles offer some powerful evidence that a crash scenario is most certainly possible and perhaps closer than most realize. The articles are available for purchase below via credit card at $25 apiece. One may also subscribe on a quarterly basis to ALL articles past and present for just $65.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.>

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ