The Chart du Jour

When polled, U.S. fund managers are almost uniformly bullish Japanese equities on a relative basis compared to other global markets -- and have been for sometime. The bid derived from this view has been consistent and welcome from Japanese banks who have used recent strength to slowly start unwinding some of their many corporate cross-holdings.

As we have previously argued however, the current environment in Japan still remains a highly unnatural one given the near-zero level of short-dated interest rates and the huge overhang of longer-dated paper to fund government deficits. There remains a large ongoing question as to how this market will ever return to a less artificial and extreme situation without further damaging the economy as it does so. Strong growth out of the blue would help, but we have been waiting for such growth for over 10-years, and it has simply never returned in a sustainable fashion. A U.S. consumer already awash in margin debt and now shaken by a 25% drop in the Nasdaq will certainly not do any wonders for the sale of Japanese exports. An already crowded gaijin-dominated trade, the Nikkei should shortly be in some trouble. Although it is certainly a minority view, we still see some risk on a Fibonacci rhythm basis that the Nikkei may even make one more new low on a monthly basis -- perhaps not bottoming once and for all until December 2001.

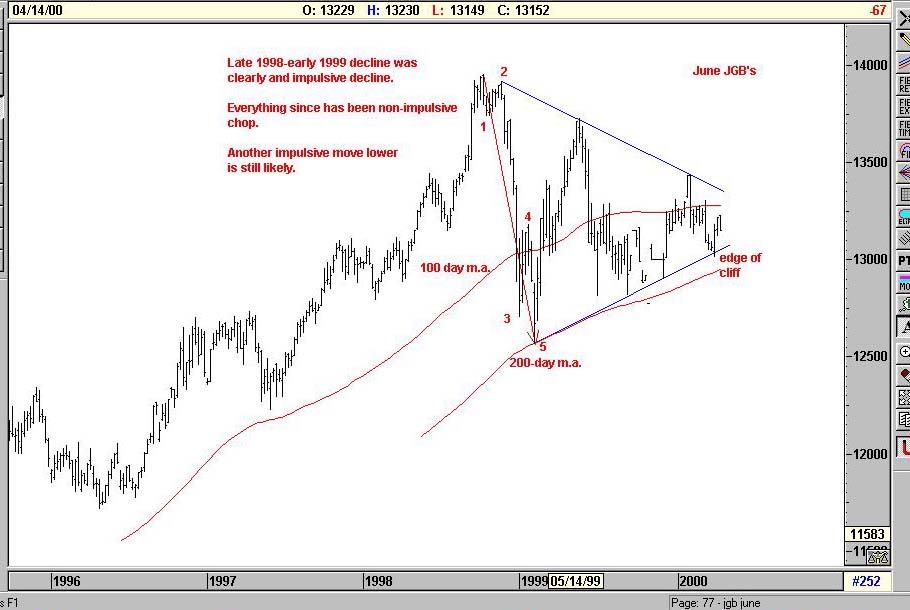

Despite this potential decline, we also look at the October 1998 to February 1999 decline in the JGB market as clearly an impulsive move lower, with everything since, corrective. Given the fundamental overhang of JGB supply, the technical chart formation, and the Big Bang regulatory changes that make capital flows out of Japan easier to accomplish, a further plunge in JGBs is clearly still in the offing -- whether helped by comments by Mr. Hayami of the BOJ or not.

So with a declining Nikkei and JGB market, what will finally be the only outlet for Japan to correct its malaise? An overt weakening yen will eventually be the only way to offset these other woes. Indeed, with an already inverted U.S. yield curve, we should soon have a fairly natural environment where the trade deficit with Japan could slowly self-correct, and the dollar is likely to rise despite equity weakness on both sides of the Pacific. Although many a fund manager has been burned in the past two years calling for the yen to go down, the rhythm of our long-term Fibonacci chart still points to 168 yen to the dollar over time.

If we were ever to see the Nikkei at new lows, the JGB yields at a less artificially low yield level, and USD/JPY back up at 168 -- then will be the time to be bullish on Japan. Not now. The system first must finish cleansing itself -- something that for too long now it has been prevented from completely doing.

Please support Sand Spring Advisors and purchase one of our more in-depth articles below.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.>

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ