The Chart du Jour

When was the last time you visited E-Bay? Did you sign up once, tour around, maybe even bid on something once for the novelty of doing so, and now can't remember your password? That was more or less my experience with this website. I suppose it has more appeal for bored housewives than daytime soap-operas, but its overall long term appeal is suspect -- at least in my mind.

Sellers of items of course probably like the concept, but there are a tremendous number of empty auction items -- no bids appearing on them whatsoever. How disappointing this must be to those who try to auction a precious keepsake for the first or second time. Someone debates long and hard whether to sell grandma's vintige Frank Sinatra record collection or set of first edition Henry James books, but then gets no bids on these items when that person makes the leap to do so. Maybe these people too never come back. I don't know, but I expect E-Bay is concerned. In addition, E-Bay is certainly not the only auction site out there anymore, their market share undoubtedly getting diluted by competition.

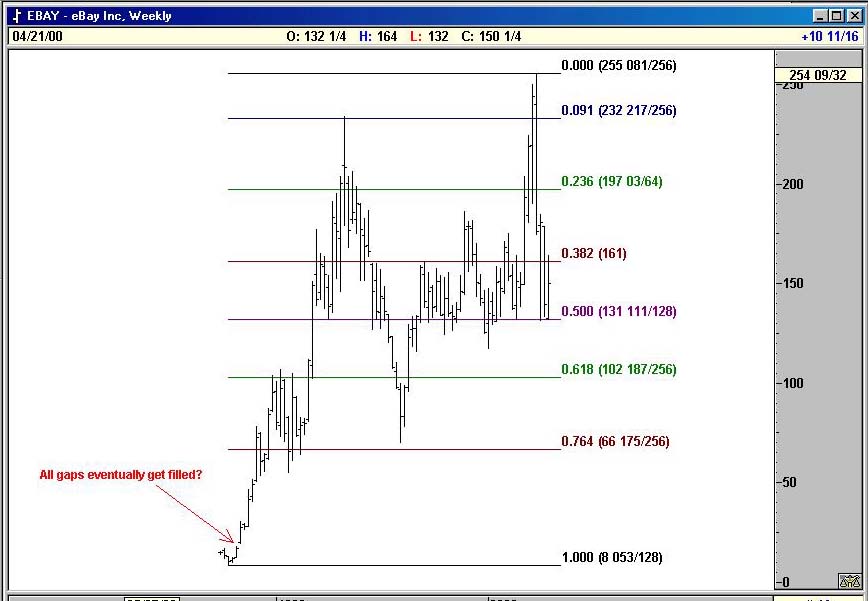

Then I look at the weekly chart below, and I see a completed looking Fibonacci rhythm, with a gap back between 18 and 21 left on the Internet's blastoff in late October 1998. With time (maybe years, maybe months...one can't say), that gap is likely to get filled. When it does, E-Bay will just be another normal company worth a still lofty market cap of $2.6 billion, down from today's still ridiculous valuation of $19.6 billion. It will likely no longer represent the hopes and dreams of millions of silly investors.

More immediately, the hourly chart of E-Bay suggests that we are in a 4th wave consolidation before a 5 of I wave down that could easily complete at or about $103.

Internet stocks may have fallen substantially in recent weeks, but the true disillusionment just begins.

Please support Sand Spring Advisors and purchase one of our more in-depth articles below.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.>

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ