The Chart du Jour

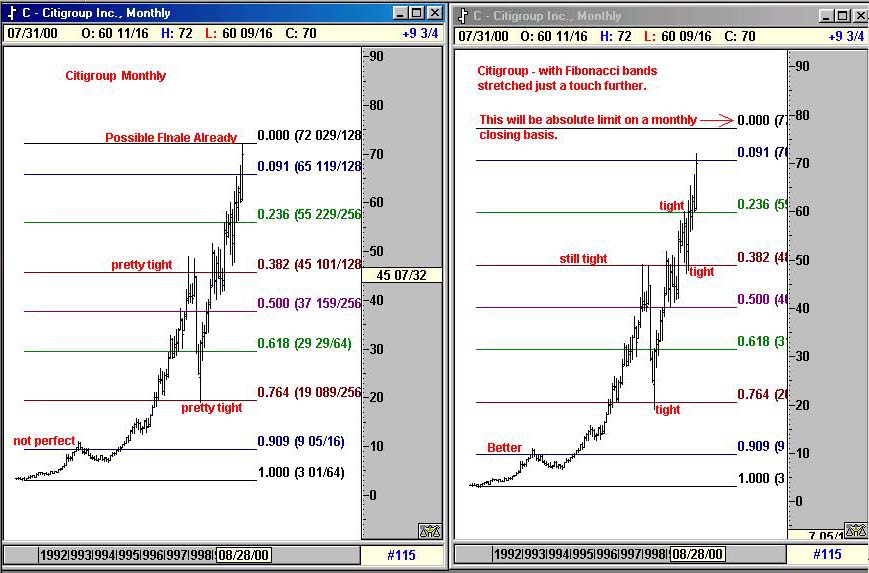

Just a decade ago in the summer of 1990, I can remember leaving the doors of Goldman Sachs on a balmy afternoon and wondering if Citbank (now Citigroup) was a bargain at $10 a share, or conversely was it perhaps going out of business. The latter part of that query may sound a bit silly in these rarified banking times, but it was a reasonable thought back then given all of Citi's Latin American debt problems. The advent of Brady Bonds solved all that of course.

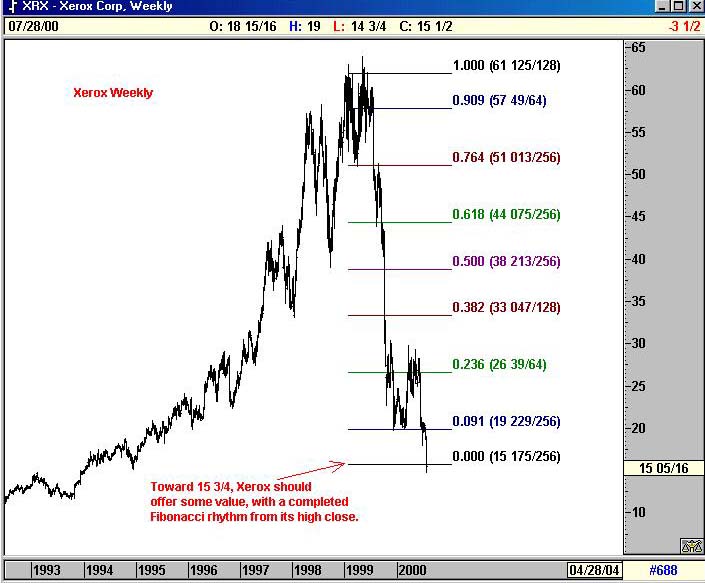

Now, ten years later I look at the stock of Xerox at $15 3/4 a share (a level we prognosticated would be seen back on June 18th). With that prior Citi missed opportunity in the back of my mind, it's pretty tempting to give this current fallen darling a shot -- even if we are equity bears at heart. After all, the stock was above $60 just nine months ago. This company's intrinsic value can't have changed that much in so short a period of time -- or can it? Its Fibonacci and Elliott rhythms also look nicely complete. Assuming one just gets a bounce at some point, might it not be worth buying 300 shares here at 15 3/4, looking to scalp out of 200 at $23 or so, and keep the other 100 shares thereafter effectively for zero cost?

Meanwhile, of course, Citigroup's valuation is now a joke, and its long term Fibonacci rhythm is largely complete or very close to being so. What a difference a decade can make. It's time to dump this one now, and look to get short here or just a tad higher.

Finally, for those who debunk astrology and its relevance to earthly markets, let's try a small experiment. I write this at 11:45 p.m. Wednesday evening for the record sake.

In his monthly letter written several weeks ago, Arch Crawford says of the day July 27th: "an extreme day for inflation hedges generally. BUY on the open, SELL on the close, or hold for higher on Monday." He then sees "individual emotional balance swamped by mass hsyteria" forthcoming on July 29-31, and a "damper on large mergers" commensurate with the partial solar eclipse on July 30-31. All that sounds pretty nasty, and given Wednesday's equity slide, downright worrisome. If it plays out a la Arch and you hear CNBC reporting on some busted merger deals at month end, remember Arch's sole forecasting method in this instance: the planetary alignments. Then ask yourself if the old expression "as above, so below" doesn't perhaps have some strange validity for reasons unknown to us.

We certainly still like the look and feel of the "spring pattern" evinced in the chart of gold miner Anglogold (shown below).

Please support Sand Spring Advisors and purchase one of our more in-depth articles below.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.>

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ