The Chart du Jour

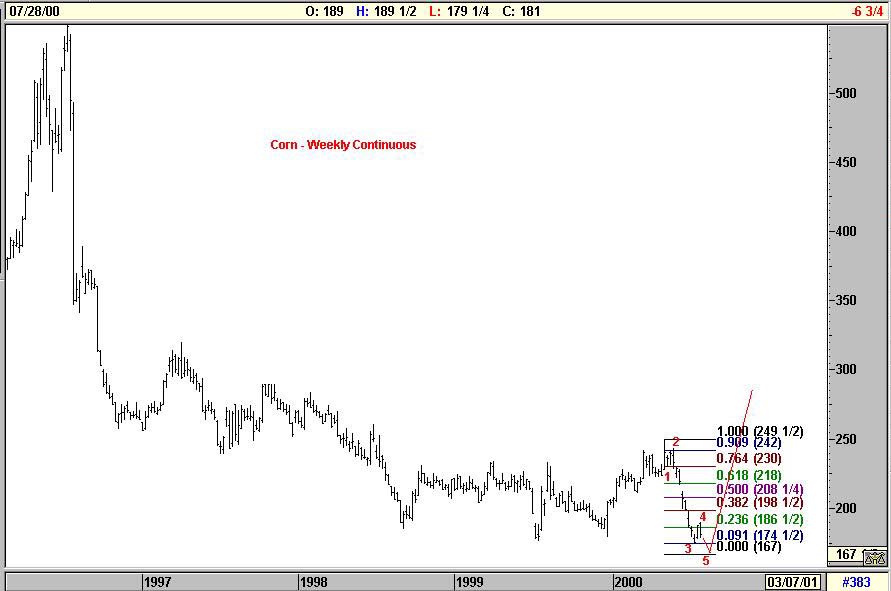

Some of our previous technical with the chart patterns of wheat and corn has been singularly premature and incorrect. These markets have continued to move lower in spite of long-term cyclical arguments that an important turn higher in these market is due right about now. But then again, the summer is not over and at present the Bullish Consensus sentiment numbers on wheat and corn stand at a paltry 3% bullish -- the very stuff viscious short covering rallies eventually emerge out of. The key word here is "eventually" because no matter how much we now look at the current pictures of wheat and corn, a low risk long entry point near current levels remains elusive. The flat bottom in the long term wheat chart may turn into a classic "rounding bottom" but it also might still fall off the edge, so to speak. And in the corn chart below, the best we spy is that this market may need one last 5th wave down toward 1.67 (to complete its Fibonacci and Elliott rhythm) before a dramatic reversal should be expected.

Most commodities have, of course, already turned higher coming out of huge lows in mid-1999. These obviously include the entire crude complex and certain of the precious and base metals (notably palladium, platinum, and nickel). We also recently experienced a dramatic reversal higher in sugar, as pictured below. The rhythm in this chart suggests an $11.81 target before significant overhead resistance will turn this market back down.

More out-of-synch commodity rallies will continue to transpire over the next year, perhaps wheat and corn eventually rallying while crude takes a short term tumble -- net-net leaving the CRB and Goldman Sachs broader commodity indices confused and choppy at best. But by August 2001, all of these markets should start becoming more closely aligned with eachother, and a concerted and broad-based commodity advance will finally transpire. There is no doubt in our minds that commodity-push inflation is coming back. It's just doing so asynchronously for the moment.

The way commodities are slowly turning to the upside is almost analogous (turned upside down) to the way equities are slowly gravitating to the downside. All the various equity indices are experiencing asynchronous spurts and declines, but behind the scenes, there is no doubt that real wealth is being destroyed. There's just so much hype and noise, few have realized this yet.

Please support Sand Spring Advisors and purchase one of our more in-depth articles below.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.>

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ