The Chart du Jour

Well Bush is in, and Gore contrite and now gone. And with Bush, it appears we may get a renewed taste of Jim Baker. Anyone who knows financial history at all will remember that it was Baker who truly set off a series of destabilizing global economic moves that essentially begot our current U.S. economic bubble and Japan's unending economic miasma.

"If the U.S. trade deficit is too large with Japan, well, let's just drive the dollar lower," was Baker's 1985 Plaza Accord tone. But as the dollar went lower, the trade deficit did not improve, so he asked on a secondary basis that the Japanese ease their interest rates. They grudgingly did so, which in turn created a huge round of domestic speculation in Japanese equities and real estate. When Finance Minister Miyazowa finally popped that bubble by snugging rates in early 1990, much Japanese money started to flow out of Japan into U.S. real estate, fixed income, and equity markets. There it made the U.S. trade deficit worse yet again, hurt the Japanese even further as the U.S. currency was continually debased, but left Americans with a glowing sense of success and hubris. Meanwhile rates in Japan were dropped so low in an attempt to re-stimulate their domestic economy (again, much at the behest of U.S. politicians) that many pension funds and insurance companies in Japan are now largely insolvent. Then, as a crowning blow, dollar-yen went down 30% in three days in 1998, leaving Japanese investors stuck with U.S assets even further under water in yen terms.

Baker wasn't responsible for it all of course, but his Woodrow Wilson School arrogance that he could micro-manage the global economy to the benefit of the U.S. economy clearly set off this daisy-chain of unintended consequences. Now he's back with George W. and it will be interesting to see what roll he plays in the new administration. Certainly many old-timers will remember his willingness to talk the dollar lower at all costs for a very long time.

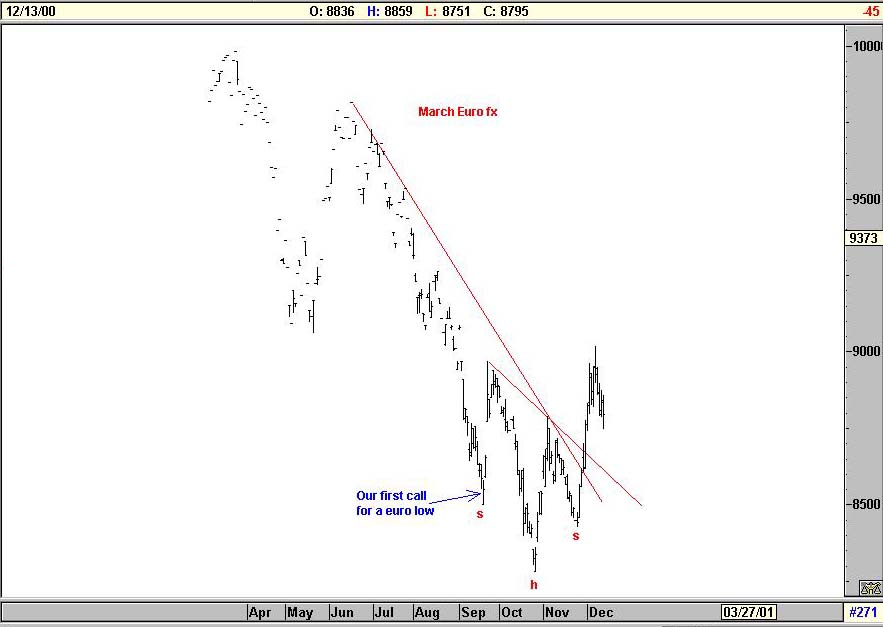

So it is we turn to the current chart of the March euro fx futures. Is that a reverse head and shoulders bottom we spy? Usually early to call a bottom, we warned of an important euro low back in mid-September. Prices have been grinding around in a sculpted bottom ever since. Now Jim Baker's potentially back. With cars not selling very well out of Detroit, we wonder what Baker's first inclination about that would be?

I am myself a Woodrow Wilson School graduate, who grudgingly voted for Bush. I am proud of other graduates of WWS such as George Schultz and Paul Volker. I am not proud of Jim Baker. He has an arrogance that grates. He also has a solid track record (particularly compared to the more astute Bob Rubin) of opening his mouth to bash the dollar at least a few times too often. If George W. were to make one good key decision it should be to leave Jim Baker in Texas -- but alas, he's not likely to. Does the FX market sense this already?

Lastly, on a completely different subject, sometimes it's just nice to take a break from the seriousness of the year 2000 Nasdaq collapse, and its portents for the future. Certainly many a bear who survived long enough to actually enjoy 2000, may have been so hurt prior to reaching this year, that being correct in the end was hardly worth the wait.

More recently, some bears stand aghast when the Nasdaq vaults 10% higher in a day. Correct in principle in their long term views, they remain non-nimble in their short term trading.

For both these camps, we invite you to open this short video file, and have a giggle. You'll need Microsoft Video Player to view it, but with such software installed on your computer, and after few moments, a short film clip should play.

Although we can empathize with the bear depicted here in so many ways, it is good for the soul to be humble as we approach the holiday season.

For immediate web-based access to our latest subscriber-only November 19th analysis, please support Sand Spring Advisors and purchase a quarterly subscription below. Our latest work will be accessible on the final page of the order process. A user-id and password for web access to all past and future articles will follow by e-mail.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ