The Chart du Jour

For those who forget the meaning of the word "perspective," the chart above should help. In a little over two years, the stock of Yahoo has vaulted on a split-adjusted basis from next to nothing to a recent print above $500 a share. Even as of Tuesday's diminished $341 3/8 close, this still puts a market valuation on Yahoo at over $89 billion, together with a P/E ratio of 1705-1.

But to anyone who really uses the World Wide Web, is Yahoo really that special? I for one find their search engine rather irritating since it first defaults to all of Yahoo's internal sub-category pages. For the same amount of time spent, I can get much greater satisfaction in a search completed using Google.com as opposed to Yahoo.com. From a technology point of view, Google is far more clean and pure a search process, and their technology has recently been heralded by several high tech magazine as the "new generation" search engine. And if Yahoo doesn't have the state-of-the-art search engine, what does it have? A web portal, some net conferencing and marketing functionalities, chat rooms, some advertisement revenue, and a second-tier auction site -- but for how long can it keep all of these? Stick together the search engine from Google with the marketing schmaltz of an iwon.com or a netzero.com, throw in a small dose of equity weakness to dishearten the financial eyeballs that currently populate Yahoo, and one can envision Yahoo losing a good chunk of its current customer base in a flash.

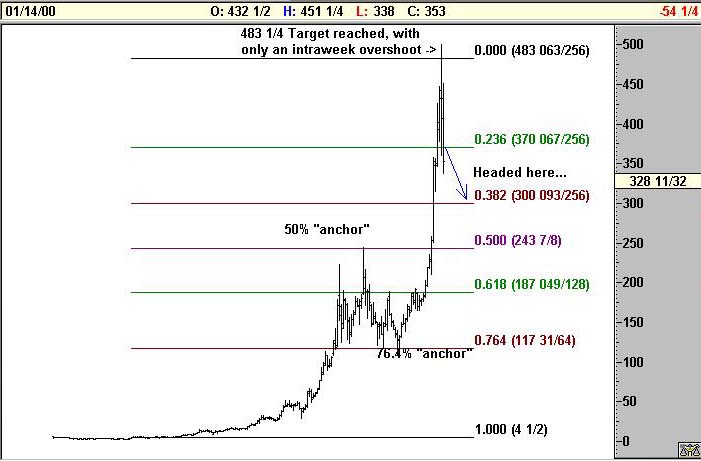

The technical picture superimposed on these fundamental thoughts just gets worse. Turning to the pattern seen in the monthly Yahoo chart above, note how the recent high in Yahoo overshot by just a little the ideal Fibonacci level at 483 1/4 whereby a 50% retracement equals the previous high of 1998, and a 76.4% retracement would equal the low of 1998 (or conversely expressed 23.6% of the entire move). To us, these two levels set the "anchors" that predefined where the subsequent blow-off in Yahoo was likely to end. That level has now been reached and rejected. This stock should now start acting like burnt toast.

Both on a fundamental and technical basis therefore, we see Yahoo as likely to migrate lower -- at least back to the $300 level, but probably even further over time. Yahoo's only possible winning strategy would be to buy out Google (still private) and upgrade its search engine technology to something more useful. Without doing so, the appeal or need to even visit the Yahoo website should slowly wane.

Am I wrong about this? Please post your comments in the Sandspring.com chatroom.

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 451 0016, FAX your request to 973-451-0016, or e-mail us at

SandSpringAdv@AOL.com| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 451 0016 Facsimile: 973 451 0016 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 1999 by Sand Spring Advisors, LLC, Morristown, NJ