The Chart du Jour

Once upon a time Inco was one of the premiere mining companies in North America, and certainly a major force in base metals production -- particularly nickel. Then they bought out Diamond Goldfields at a high price to gain control of the largest untouched nickel deposit in North America, and the company has largely been slipping and sliding downhill ever since. In between 1995 and 2001 for example, Alcoa, the largest aluminum manufacturer in the U.S. doubled in value, and currently trades at a P/E of 21.5. Inco, by comparsion over the same period of time has halved in value, and currently trades at a P/E of just 9.5. A large debt burden and constant regulatory hurdles on their new nickel properties have been the ever-present drags on performance.

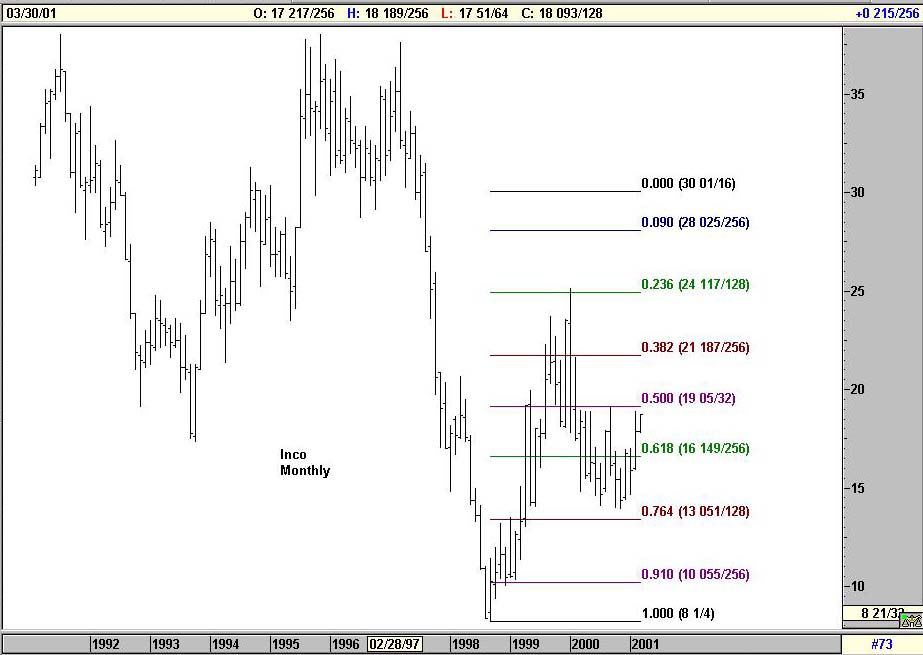

But a month ago, Inco's CEO was ousted. The stock has been showing good relative price behavior even while the overall equity market has been weak. Our Fibonacci bands on the monthly chart further suggest an eventual recovery toward a $30 U.S. price target.

We like Inco here far more than we like Alcoa -- particularly as the U.S. economy softens and aluminum demand for auto production isn't likely to be particularly robust.

So here then is yet another paired trade to add to our previous suggestion of long CSG versus short KO. With so many of these ideas recently percolating in our heads, maybe Sand Spring Advisors should open a long-short hedge fund itself.

Subscribers are invited to click here for immediate access to our latest in-depth article: "Measuring Financial Time: The Magic of Pi." The article is 10 pages in length, and in it, we touch upon two centuries of financial history. We also leave readers with our cyclical vision for the next decade, as well as a shorter term perspective of the NASDAQ 100 index for the balance of the year.

Non-subscribers are invited to sign up for a quarterly subscription below.

It also may be of interest to some as well that because so much time (and thus timeliness) has now transpired, we recently released three of our 2000 subscriber-only articles. These now appear under the public Earlier Articles section of the website. Perusing through them may give one a sense of the added premium level of analysis we provide to subscribers.

For immediate web-based access to our latest subscriber-only February 25th analysis, please support Sand Spring Advisors and purchase a quarterly subscription below. Our latest work will be accessible on the final page of the order process. A user-id and password for web access to all past and future articles will follow by e-mail.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ