The Chart du Jour

Back on March 6th, with Alcoa trading near $38 and Inco trading near $18 (or a ratio of approximately 2.11-1), we recommended a possible spread trade to sell Alcoa and buy Inco. Relative price-earnings ratios seemed to support this, as well as the prospect for a softening U.S. economy putting a damper of aluminum demand for autos, etc.

This spread was slightly in the money until the last half of March when Inco stumbled $3.5 to just under $15. A worried reader with the spread already positioned has quite rightfully written in asking what is to be done.

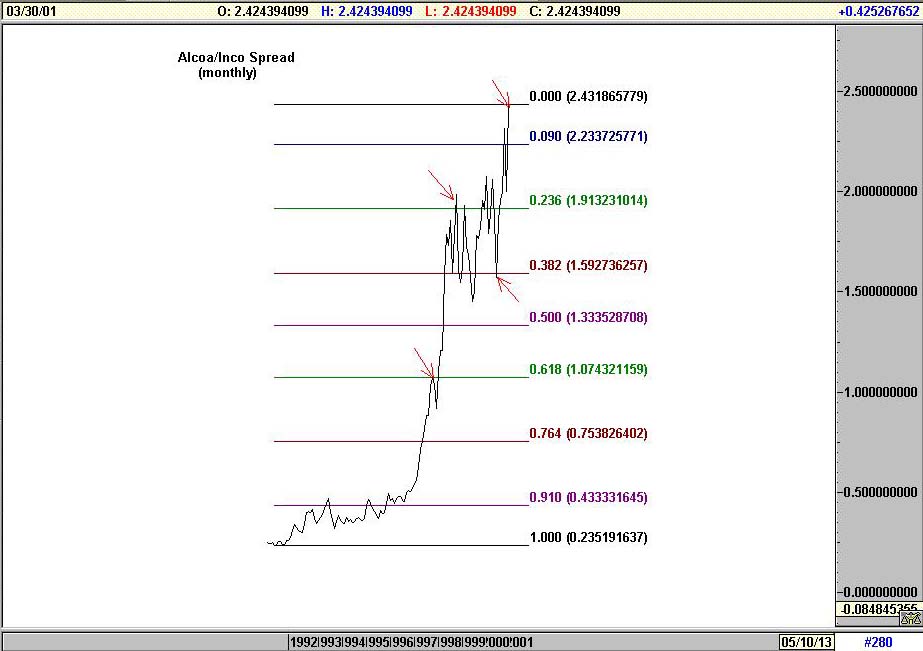

While we try never to get too stubborn in our views, and there is always a place to cut and run, our view on this spread at this time is to hang in there. The monthly chart above shows the ratio of AA/N going back to 1991. This last spike is unfortunate, but the Fibonacci rhythm of the overall pattern suggests pretty strong resistance around current levels.

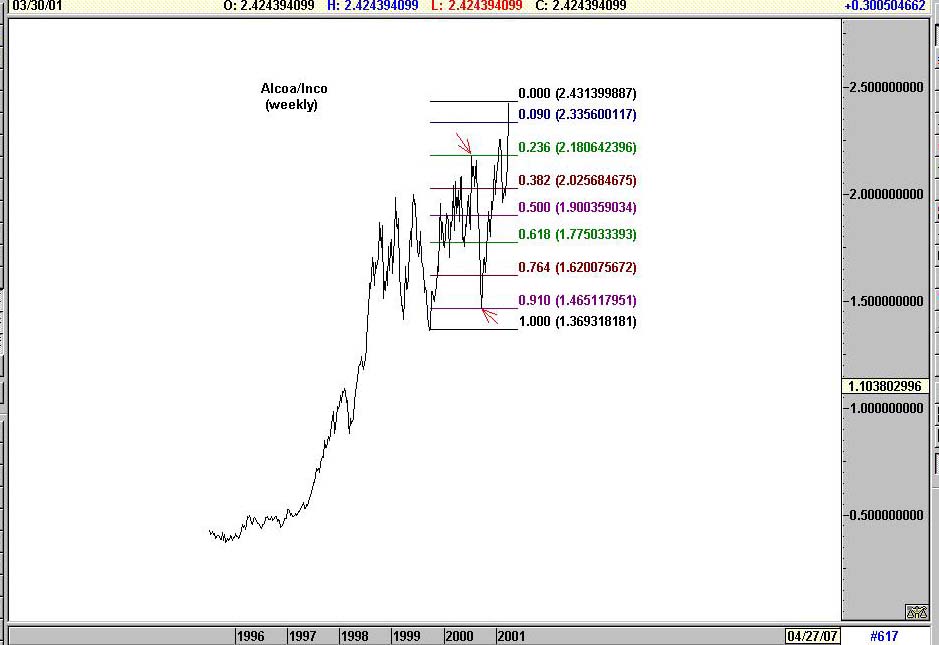

Zooming in to a weekly view of the spread in the chart below, we also think that Alcoa's recent outerformance of Inco is likely a final hurrah. Breaking the spread down into it component parts in search of logical stop-loss levels, only if Alcoa goes back above its March 8th 39 37/64's high or Inco below last November's $13 15/16 low would we get more concerned with this spread.

Even when the fundamentals are on your side, the overall market volatility these days easily risks spread trades like this going temporarily awry. One likely needs to give them a bit of breathing space.

Subscribers are invited to click here for immediate access to our latest in-depth article: "Measuring Financial Time: The Magic of Pi." The article is 10 pages in length, and in it, we touch upon two centuries of financial history. We also leave readers with our cyclical vision for the next decade, as well as a shorter term perspective of the NASDAQ 100 index for the balance of the year.

Non-subscribers are invited to sign up for a quarterly subscription below.

It also may be of interest to some as well that because so much time (and thus timeliness) has now transpired, we recently released three of our 2000 subscriber-only articles. These now appear under the public Earlier Articles section of the website. Perusing through them may give one a sense of the added premium level of analysis we provide to subscribers.

For immediate web-based access to our latest subscriber-only March 20th XAU chart analysis, please support Sand Spring Advisors and purchase a quarterly subscription below. Our latest work will be accessible on the final page of the order process. A user-id and password for web access to all past and future articles will follow by e-mail.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ