The Chart du Jour

The overall market is turning higher. Will it do so in a straight line, in a wush up? It could, but we doubt it. The underlying fundamentals and valuation levels in many stocks are simply too poor. It's only the short term downside momentum of the market that is washed out. "Back and fill, grind and push" is thus more likely to be the order of the day within a path of least resistance that technically is up.

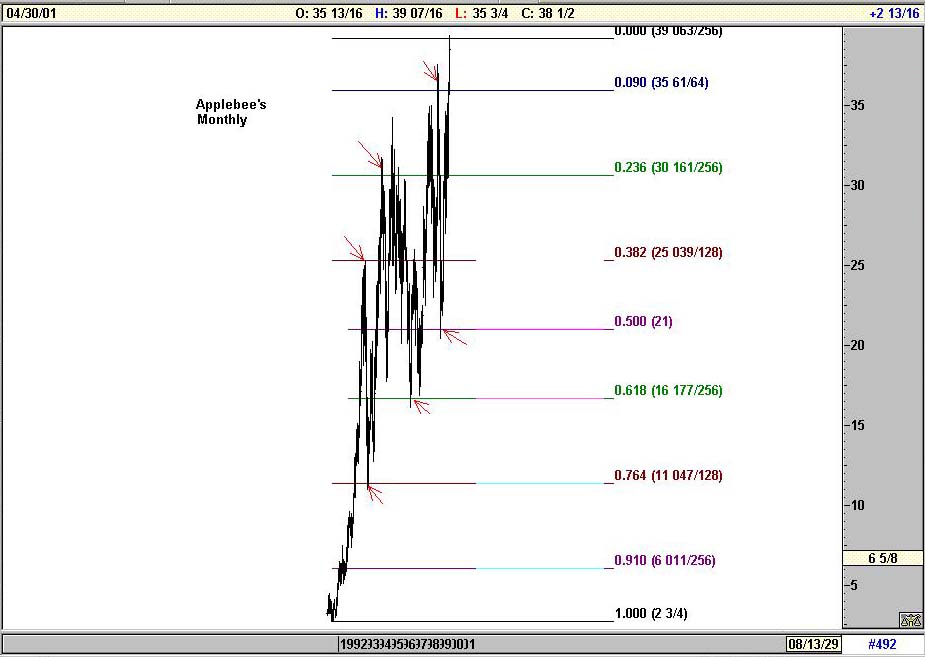

In addition, as with our negative call on Starbuck's a few weeks ago, we continue to find stocks that look ripe for sale. The one above is the restaurant chain Applebee's. Somehow at the moment, Wall Street has gotten as far as beating up on fast food stocks such as McDonald's (MCD) and Tricon Global Restaurants (YUM), but investors are still chasing mid-level restaurant chains like Ruby Tuesday's (RI) and Applebee's (APPB).

To date, of course, the shopping malls (where these latter restaurants are widely located) remain full. But when the recent nationwide round of job-cutting starts to hit home, America's malls certainly aren't likely to stay that way.

At 16 times earnings, with earnings having recently grown at approximately 15% per annum, maybe Applebee's is a great growth stock -- but we doubt it. Not only does its Fibonacci rhythm on the monthly chart look reasonably complete, but at the end of the day, a grilled-cheese at home is a lot less expensive than that burger at the mall. Eating out is one of the easiest costs for people to cut back on when times turn tough -- as times most certainly are beginning to become in the real world. Ruby Tuesday's, at an even loftier P/E of 28-1 also technically looks like a sale to us.

Our suggestion: If you need to have shorts in your portfolio, rotate out of tech shorts into APPB and RI. To our eye at least, these stocks look set to follow SBUX recent 25% tumble.

Non-subscribers are invited to sign up for a quarterly subscription below. Sand Spring's latest subscriber-only article "Four Themes for 2001 and Beyond," as well as our prior February 20th article "Measuring Financial Time: The Magic of Pi," will both be accessible on the final page of the order process. A user-id and password for web access to all past and future articles will then follow by e-mail.

It may also be of interest to some that because so much time (and thus timeliness) has now transpired, we recently released three of our 2000 subscriber-only articles. These now appear under the public Earlier Articles section of the website. Perusing through them may give one a sense of the added premium level of analysis we provide to subscribers.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ