The Chart du Jour

Despite the perceived wisdom that lower interest rates are bullish for mortgage finance stocks, Fannie Mae has been unable to muster a substantive rally over the past three months. There are an increasing number of "For Sale" signs appearing across America, but at the still lofty prices offered, many houses -- particularly in California -- are not moving.

At some point in this cycle we expect all those "assessed valuations" underlying America's mortgage commitments to wreak a bit of havoc in the mortgage lending market. Should a house that was worth $650,000 three years ago, and assessed via comparable last sales as being worth $1,200,000 today, really supposed to currently be eligible for a $1,000,000 mortgage? That's the functional case on both the East and West coasts today. Even though this example involves so-called "jumbo loans," there's a problem brewing here.

Hedge fund managers we have recently met all categorically state that "If there was an easy way to get short California real estate," that this would "likely be the best trade for 2001-2002."

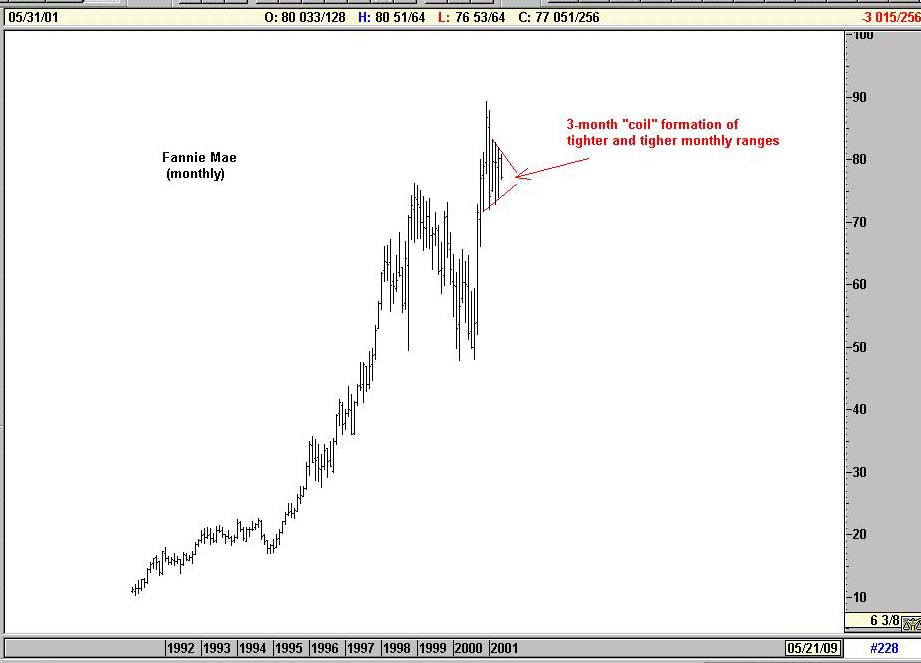

We don't have particular expertise here, but we do see the 3-month "coil" in Fannie Mae as a potential warning sign. If prices were to start breaking down from this coil, it would likely be a sign that real estate investments across the country are going to start diminishing in value. Where the "chicken" and the "egg" are in the Fannie Mae case, are not all that important.

Subscribers are invited to click here for a closer look at the FNMA daily chart and immediate potential downside targets if this "coil" resolves itself to the downside.

Non-subscribers are invited to sign up for a quarterly subscription below. Sand Spring's latest subscriber-only article "Expert Short Picks," as well as our prior February 20th article "Measuring Financial Time: The Magic of Pi," and current "FNMA Daily View" will both be accessible on the final page of the order process. A user-id and password for web access to all past and future articles will then follow by e-mail.

It may also be of interest to some that because so much time (and thus timeliness) has now transpired, we recently released three of our 2000 subscriber-only articles. These now appear under the public Earlier Articles section of the website. Perusing through them may give one a sense of the added premium level of analysis we provide to subscribers.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ