The Chart du Jour

I was somewhat amazed at the aftermarket this evening as traders immediately jumped on Microsoft's comments of "improved business conditions," and simultaneously chose to ignore their $3.9 billion tech portfolio write-down. CNBC barely mentioned the latter bit -- clearly deeming a marginal improvement in operating earnings to be more important than the past devastation of the company's investment portfolio. Who cares if Microsoft's $900 million investment in Winstar Communications is now worthless, or that its $30 million investment in RhythmNet Communications now trades at 6 cents a share?

To us this is almost equivalent to the guy who comes home from work and says to his wife: "Honey, I have great news! The boss just gave me a 5% raise." But later in the evening he sheepishly admits to his wife "I'm afraid we'll need it, because I just blew half the value of our retirement savings speculating online in my IRA account." Overall, is that couple really better off -- both events considered?

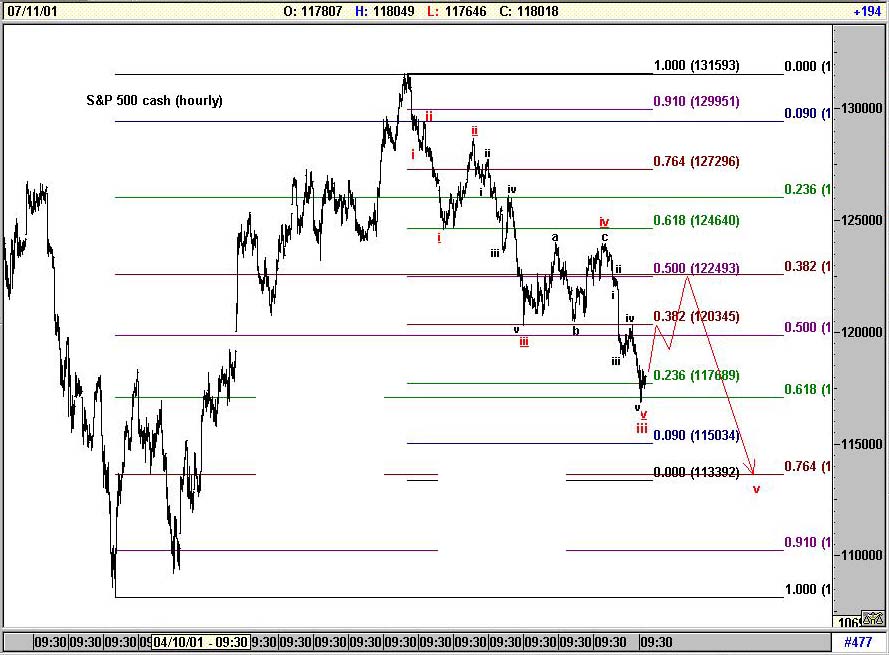

Whatever the case, the Microsoft earnings announcement appears sufficient psychologically to cause a short term bounce in the S&P and other indices. When we look at the above hourly chart of the S&P 500 cash index, we discern what was likely a completed iii of iii down into Tuesday morning, with a iv wave period of minor reprieve to now follow. That said, we also think it will be highly likely that any rally beginning at this time should fail below 1225 on the S&P, and that on a more intermediate basis, we are still headed lower toward a S&P target (on the hourly chart at least) near 1134.

None of this grind lower -- together with intervening sharp rallies -- is particularly fun to trade for bear or bull alike. But there does now appear to be a more developed rhythm discernable amidst the chop. Consider it some version of a fox-trot: two-steps lower, now a step up, followed by a few steps back down once again. While it's not easy to always find the market's true beat, Elliott and Fibonacci most assuredly still govern the sodden tempo here.

And what of Microsoft up $4 in the after-market to 70 1/2? The houry chart pattern of MSFT (not shown) is most clearly a "broadening formation" indicating more volatility on the way here in the near future. If the bulls really get their verve up, maybe MSFT could vault up to 78 1/2 in a real ramp job over a few days or weeks. But mark our words: This evening's news will eventually disappoint and fade from importance. It is not a good reason to get all lathered up and start betting that a new bull market is upon us.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ