The Chart du Jour

Excuse us for one moment while we berate American news journalism. There is a major war brewing in Israel Palestine; there is another war ongoing in Macedonia; there is a major drought and famine across much of Africa and the sub-continent; and this coming weekend could easily bring major European riots as G-8 leaders meet to discuss free trade.

And yet amidst all this, what does ABC News choose to lead off its evening World News Tonight broadcast? -- The raising of the Kursk submarine -- a puff story for now. The more worldly CBS Evening News was even worse: Traffic across America during summertime holidays. I only flipped through NBC for a moment, but it had something equally as trite.

Led by our soft-news media, America has its "head in the sand" trying not to pay attention to how angry and ugly the world is slowly becoming. Global riots and wars just aren't selling that well on the networks, so the networks shuffle them further down the newscast featuring instead something more flashy, amazing, or even sex-related like Rep. Gary Condit's roving dick. There's nothing like a good soap opera with potential murder and sex in it. After OJ and eight years of Clinton, America has become adicted to learning how sick and amoral our leaders truly are.

In financial circles, concern about an Argentinian default is nowhere on our news channels, but when Intel beats its lowered earnings estimates by 2 cents, Dan Rather gives that non-event a mention as "a potential sign the economy might be finally turning."

We're sorry, but this psychology is all wrong. America is setting itself up for a rude awakening. Wars and protests abroad will matter at some point soon.

On top of all this, no one in the popular media has yet to spend any time covering the fairly substantive turn that has recently taken place in many raw commodity prices such as wheat, corn, and soybeans. Prices of gasoline might not only be high now, but driven by a global drought this summer, basic food prices are now starting to move higher as well.

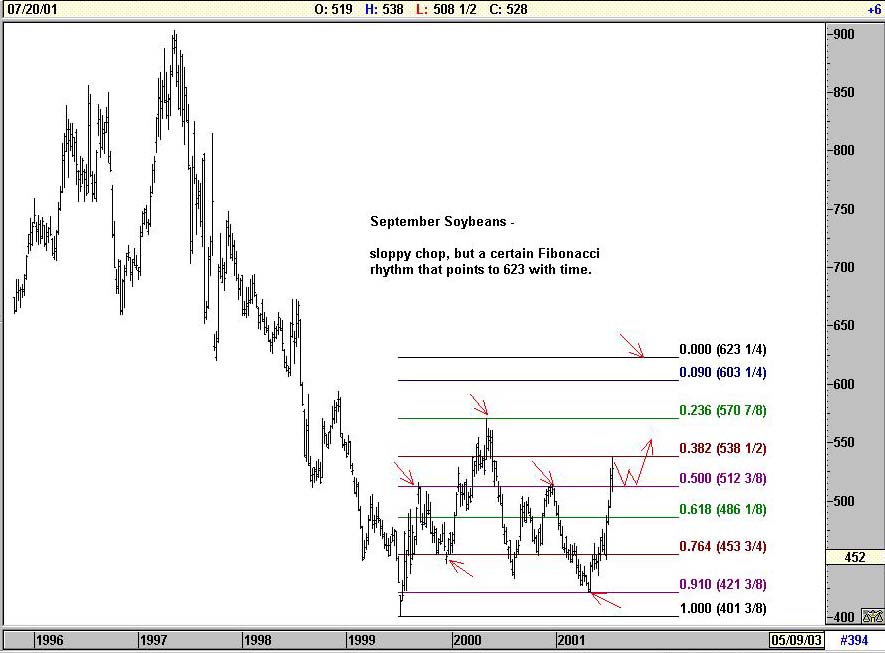

We apologize for being a bit late to comment about these turns ourselves, but we do want to at least point out to our readers how corn, wheat, and soybeans have all now risen above their long-term 100-week and 200-week moving averages. Pullbacks would appear buying opportunities to us.

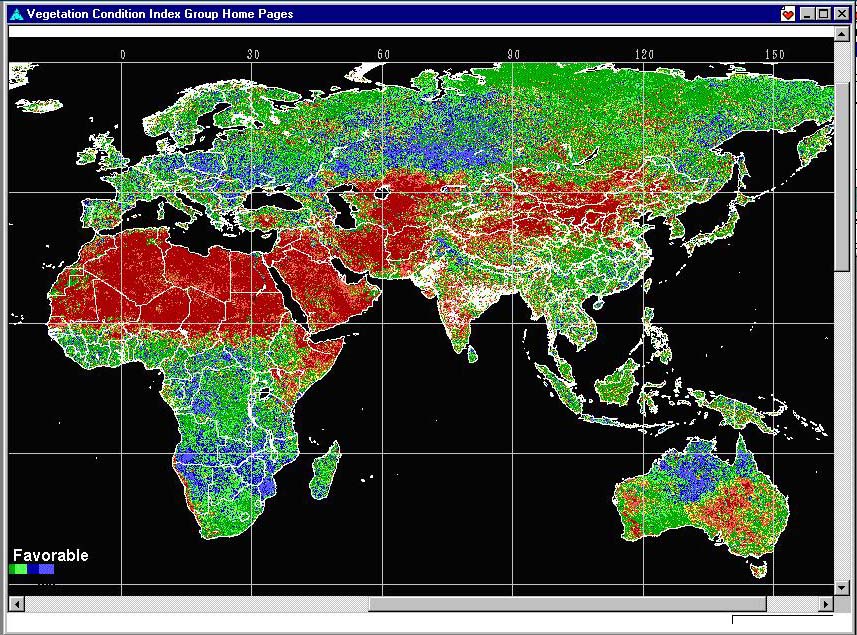

And it's certainly hot out there -- not only in the U.S. and Canada -- but particularly across Africa, Asia, and to a lesser extent even in Europe. On the chart below, the red colored zones are far more concentrated drought areas than existed last summer. In our mind at least, heat not only turns soybean and wheat prices higher, but it also breeds more violence -- it makes people more hot-headed.

So if you want to be silly and listen to the next tech company that beats lowered earnings estimates, and read this news as a sign of an impending U.S. economic recovery -- be our guest. But we think you will be listening for the wrong bit of news, and certainly missing the bigger macro risks out there. The world is simply getting angrier, madder, and hotter. One day soon -- maybe even by this weekend -- that anger will overboil.

America needs to get its head out of the sand and realize the importance of all this. It's out of the current mindset of denial that true crashes unfortunately get born. Instead of featuring a submarine salvage effort that will take several weeks if not months to complete, or featuring ad-nauseum other topics such as the trials and ramifications of Gary Condit, our news media should be doing a better job showing us the true world out there -- a world that on several fronts is most clearly teetering on the edge.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ