Sand Spring Advisors LLC

VIX Time

January 9, 2002

by, Barclay T. Leib

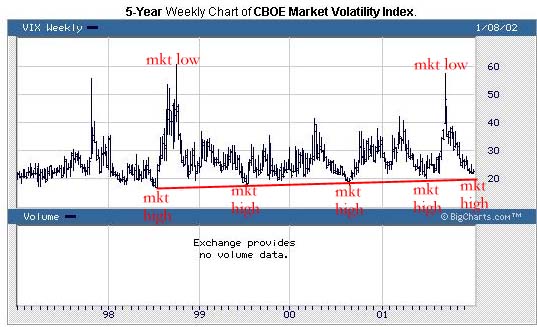

There is of course no perfect leading market indicator, but for the past five years, the CBOE Option Volatility Index (VIX) has been better than most.

When the VIX implied volatility index spiked above 50 last September 21st, you had the makings of a "panic" bottom. And such was the case back in the fall of 1998 as well.

Conversely, when the index compresses in the 20-23% region, you likely have the makings of a market top with too much complacency. Such was the case last February when a 22.05 low on the VIX index correctly marked a market high -- Greenspan's January 2001 rate-cut notwithstanding. Such was the case again in July 2001, when the index made a yearly low at 20 right before the market turned rather nasty again in August and September. Such was the case once again mosty recently as the index dipped into the mid-22 zone over the past few days.

The VIX is certainly not a perfect indicator to measure when a reversal is immediately about to transpire. Is 22.5% cheap enough, or does compression to 20% or even a bit lower have to transpire first? Answering that question can often be tricky. But taken together with what appeared Wednesday to be "key reversal" day in the major market indices, 22.5 is low enough for us to get excited that a reversal is at hand. Indeed, the VIX popped in Wednesday trading back above 23 in a potential volatility breakout.

Put this all down as another "technical" nail in the coffin of current market bulls. The next two nails to be hammered into the bullish mantra will be when the 100-hour moving average of the hourly S&P 500 bar chart is clearly broken (we closed right on top of it Wednesday) together with the 200-hour moving average of the hourly S&P 500. That latter level currently resides near 1148.

Non-subscribers are invited to sign up for a quarterly subscription below. Sand Spring's latest thoughts will all be accessible via an immediate e-mail. A permanent user-id and password for web access to all past and future articles will then follow by a separate e-mail.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Disclosure Statement

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

973-829-1962 or by email at the address below:

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

Click here to start.

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2000 by Sand Spring Advisors, LLC, Morristown, NJ