Sand Spring Advisors LLC

91% Retracement & The Ancient Language of Mathematics

October 4, 2002

by, Barclay T. Leib

Chart constructed using Advanced GET End-of-Day

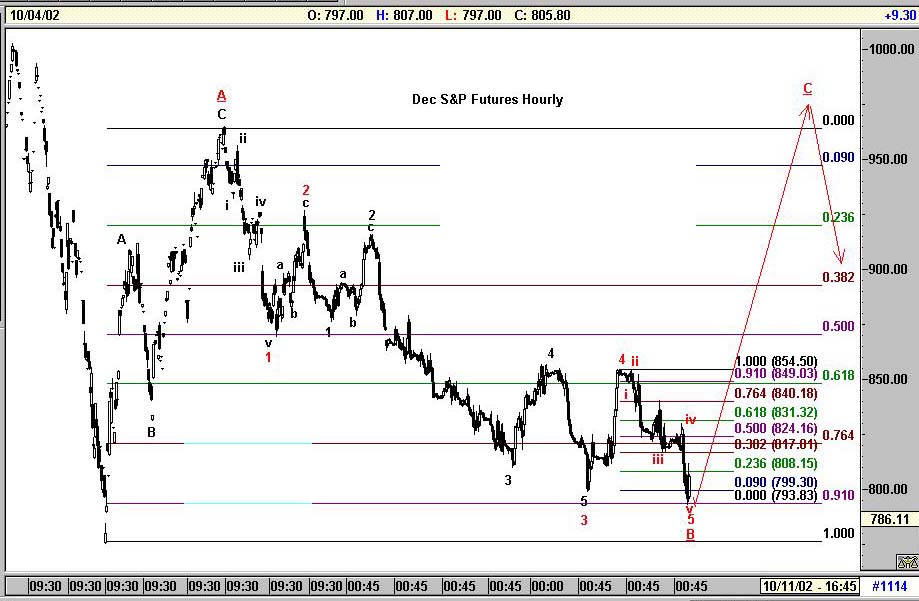

Well on Friday, the S&P slipped and closed below 814 where we had hoped it would hold: scary, yes - but a definitive collapse in the offing Monday? Anything is possible of course, but we continue to think not. Basis the December S&P futures we basically stopped Friday just at the 91% retracement level of the July-August advance. If July-August was only an A wave within a larger A-B-C corrective chop, then today's close is just about as far as a B wave can fall to still be a B-wave. But a B-wave it still can be, with a surprise C-wave still lurking into our November 7th cycle window.

This is a tight call, and obviously not worth betting the ranch on. Our game plan is to throw in the towel on this view on one more hard day down beyond current price levels. Thereafter 7130-40 on the Dow would be a next stopping point we'd be looking for, and we'd likely have to shift our view toward a November 7th low instead of a November 7th reaction high. But for now we must stick to our A-B-C game plan as previously laid out.

What is particularly difficult about the current situation is envisioning the fundamental event or future headline that could occur to suddenly shift sentiment to the topside. About the only fundamental event that we could see arriving at this point to temporarily save the day would be a surpise European rate cut. And with interest rates in Europe still at the levels of 1999 boom times, why is the ECB dallying so? Do they really want to turn the financial system of Europe into the next Japan? Shouldn't the ECB at least be trying something -- even if the real problems in Europe are structurally high labor costs and excessive business taxation.

We discuss the macro picture in Europe a bit more within our latest subscriber-only Sandspring.com monthly article being released today, and we also compare Europe to the improving economic picture in Asia. Within this article we also spend a great deal of time moving beyond our immediate November 7th cycle date and looking for "pi rhythm" dates of potential importance in 2003 and 2004. For those curious about pi in general, we also offer much historical context that in our mind holds much fascination.

Given wide this range of topics, this article carries a somewhat long-winded title, 72, 22, 7 -- The Ancient Language of Mathematics, Upcoming Pi-related Cycle Rhythms & The Macro Picture in Europe and Asia in Relation to the U.S. Subscribers are invited to access it by clicking on this hyperlink and entering their user-id/password combination. Non-subscribers are invited to sign up below for a quarterly subscription to Sandspring.com below and gain immediate access to this work.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Disclosure Statement

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

973-829-1962 or by email at the address below:

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

Click here to start.

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2002 by Sand Spring Advisors, LLC, Morristown, NJ