Sand Spring Advisors LLC

Deer(e) in the Headlights

October 31, 2002

by, Barclay T. Leib

A few days ago, as dusk fell on the bucolic landscape of Harding Township, New Jersey, a deer bounded out of the woods and ran smack into my car. No one was hurt, and insurance covers the auto damage, but the very event reminded us of how today's markets are behaving. The mindset of the investing public is still to stay invested "for the long-term," but surprise events keep popping up to dash any short-term build-up of positive market momentum.

As we move into our November 6-7th cycle window, we do not want to over-anticipate this market. Rather, we want to be attentive for news events and geopolitical events that will set the ongoing tone of this market until our next 8.6-month cycle window in Jun-July 2003.

Among the news events that we would not be surprised to see hit, one could obviously be a new bank debt package emanating from Japan. This might prove disappointing to the market or be well received. Another possible event, from a geophysical point of view and given recent rumblings at Mt. Etna in Italy and Kilauea in Hawaii, might be a major earthquake in some populated global locale. Or maybe Bush will be on the move in Iraq, or the next major corporate accounting scandal will come to light. Or maybe Greenspan will lower rates on November 6th, but the investing public will only be momentarily euphoric, and equity prices will subsequently drop anyway. It's simply hard to tell.

And in this particular technical situation, with the market meandering at a non-descript 895 level on the S&P, it's actually dangerous both psychologically and potentially financially to try to out-guess the market's future path too much. On a general basis,we continue to expect that should the S&P be at or above 928 by the latter part of next week, the new news and tone to the market will likely be bad thereafter. Alternatively, as our less anticipated but still possible path, should the S&P 500 be down near 848 or 807, one might expect the emanating new news and market tone to be positive.

Meanwhile, in anticipation more of the former course, it is important for us to start thinking of new names to potentially short. One of these is Deere & Co. not previously covered at Sandspring.com.

In a recent excellent analysis done by the fine people at Apogee Research (associated with Grant's Interest Rate Observer), a few facts about Deere are brought to light:

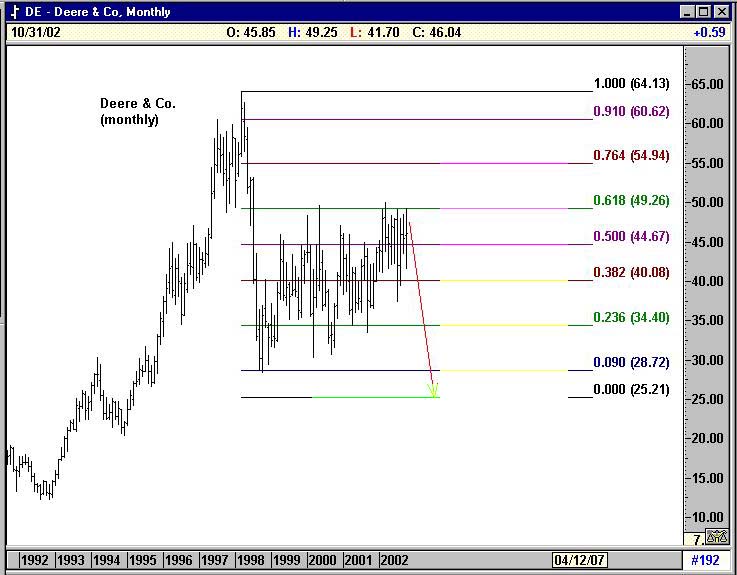

Add to all of the above, the Fibonacci chart rhythm shown below that implies a missing low down toward $25.21, and Deere is now on our "hot list" as a potential short sale.

- Deere has recently financed many of its new heavy equipment sales and been forced to accept a flood of used-equipment trade-ins in its fight to maintain earnings. At least two-thirds of the company's revenues now depend upon interest-rate sensitive credit operations. Lower rates in recent quarters have clearly helped Deere's financial performance, but if rates now start to get sticky, this one-off past gain from lower financing costs will not be repeated to the same degree. Much of this dealer-provided financing currently sits on Deere's books as a burgeoning receivables figure. This is even worse given an increasing percentage of Deere's sales that originate from leases. These leases are under Deere's carry costs and have their profitability dependent upon the residual value assumptions of equipment turned back in after leases expire. A glut of used trade-ins will over time also risk cannibalizing future new equipment sales. To us, this sounds like another Sears in the making.

- Deere trades at a rich valuation (44 times estimated 2002 earnings and 20 times over-optimistic 2003 estimated earnings from the Street) despite languishing fundamentals (poor return on assets and equity as well as decreased margins), and an agricultural environment that despite higher crop prices of late, is still very sick (U.S farm income is expected to reach a 16-year low this year, and rising ag prices have been of little help to farmers with fewer drought-induced crops to sell and more expensive feed-grain prices for livestock. Beef consumption and prices are also in the sewer);

- Like most old-economy manufacturers with a heavily unionized workforce,Deere has many nasty pension liabilities looming in the future. The company's current 9.7% return assumption on its assets is clearly too high given the degree to which financial markets have fallen in recent years. Any admission of this could cut Deere's earnings by a up to a third, and cut the company's current book value of Deere by 15%. Unless a new bull market suddenly emerges, Deere will soon have to cough up real dough into its pension plan to avoid being deemed underfunded. The company's approximate $3 billion underfunded status represents something on the order of five years worth of Deere's average net income;

- Overall, Deere has increased its leverage while its interest coverage has deteriorated. With time, this could endanger Deere's dividend that has remained at $.88 per annum in recent years despite non-existent 2001 earnings. Assuming current targets on 2002 earnings of $1.06 are made, Deere's payout ratio remains high at 83%.

Chart constructed using Advanced GET End-of-Day

Non-subscribers are invited to access this August article, together with our more recent October 4th subscriber-only missive ("The Ancient History of Math, Current Pi Cyclical Rhythms, and The Macro Picture in Europe and Asia in Relation to the U.S") by signing up for a quarterly Sandspring.com subscription below.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Disclosure Statement

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

973-829-1962 or by email at the address below:

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

Click here to start.

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2002 by Sand Spring Advisors, LLC, Morristown, NJ