Sand Spring Advisors LLC

Angry Sun & Silly Barron's Cover

June 14, 2003

by, Barclay T. Leib

Barron's Cover 6/14/03

So here we sit in early summer bemoaning the East Coast's drab weather and the somewhat sickening liquidity-driven froth on Wall Street.

But lo and behold, we also spy the Barron's cover above that arrived in our Saturday mailbox. It pokes fun at equity bears and boldly pronounces in an associated cover headline, "Even if a summer lull sets in, stocks are likely to be 10% higher by year end."

It's no wonder Alan Abelson took the week off from his editorial chair. He's likely barfing somewhere at the memory of another Barron's prognostication:

"It is apparent that the public preference for stocks is not only as marked as ever, but also, the will to speculate is still a speculative factor not to be overlooked. The prompt return of huge speculation and the liberal manner in which current earnings are again being discounted indicates that it will be difficult to quench the fires of stock market speculation for long."This latter quote of course appeared back on March 24, 1930 on a substantive equity market bounce post the late 1929 meltdown -- and right before the true nastiness of the Depression became obvious.

Meanwhile, plebian earth-bound Barron's hardly realizes the tumult all around us. As the Full Moon shines down upon us this weekend, so too is a very active Sun. To quote from one slightly more attentive (albeit off-beat) source, EarthChangesTV.com, that is paying a bit closer attention to the heavens:

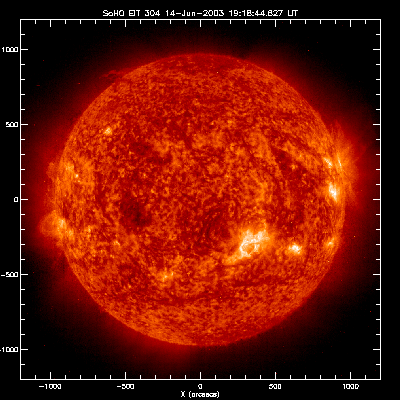

Over the past week a reported 65 C-Class flares, 16 M-Class flares, and 2 X-Class flares have occurred. Just the week prior, another 2 X-Class flares and 4 M-Class flares erupted. In addition to the solar flares, perhaps as many as 45 CME's (coronal mass ejections) emerged.Another area of concern is our 'power grids.' If Earth experiences a direct hit from any one of these M-Class or X-Class flares, it could in fact cripple our infrastructure. There is good reason to be concerned over this issue. Some of you may remember what happened in 1989 when an X-Class flare ripped through our Magnetic Field knocking out power grids all across parts of the world.

One area which suffered a devastating hit was Quebec, Canada. Power grids were knocked out for almost two months. This occurred during winter months and people literally had to set up emergency communities to survive. Those who had homes with "fireplaces" quickly filled to as many as 20 to 30 people per household. An area of over 7 million people was reduced to using fires as a method of warmth and to cook meals....

Today's sunspot count is at 168. I am a bit nervous of region 380. It is very large and is set dead center which could produce a direct hit to Earth. The odds of an X-Class or M-Class flare erupting from this region is 90%. I would suggest it is almost certain. The question is not if an eruption will occur, but in what direction.

Watch for "freak storms" to continue. More than likely in the way of tornados or tornado-like winds. Sudden rain and hail storms are likely. Also watch for 'record breaking' temperatures.

Equation: Sunspots => Solar Flares => Magnetic Field Shift => Shifting Ocean and Jet Stream Currents => Extreme Weather and Human Disruption.

Source:NASA

In the photo above Region 380 is the bright orange area of solar disruption just to the lower right of the the Sun's center. A coronal mass ejection from Region 380 headed toward Earth could easily cripple America's satellites to an extent that our Department of Defense may not wish NASA to admit or even warn about.

Overall, the 11-year solar sunspot cycle was supposed to peak in 2000, but an angry Sun continues today. Yet Wall Street appears oblivious, and Barron's only offers us cute covers that strike a contrarian chord.

Non-subscribers are invited to access our May 26th article, "Debt Bubble & Islamic Threats," together with other past articles, by signing up for a quarterly Sandspring.com subscription below.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Disclosure Statement

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. The opinions expressed are not intended as specific investment advice, and simply represent our personal views offered here under our right of free speech. Sand Spring Advisors is a NFA registered CTA/CPO, but is not a Registered Investment Advisor. We do not directly trade any client funds. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and we will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

<

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

973-829-1962 or by email at the address below:

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

Click here to start.

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2002 by Sand Spring Advisors, LLC, Morristown, NJ