Sand Spring Advisors LLC

Blagh Reaction to Supposedly Good News

July 23, 2003

by, Barclay T. Leib

It is of some note that Tuesday brought both supposedly "good news" from Iraq with the death of Saddam Hussein's two sons, as well as much hyped Amazon.com earnings that beat expectations. If the market were really ready to launch another leg to the upside within its ongoing steady ascent from mid-March, we would have expected stronger price action yesterday and today.

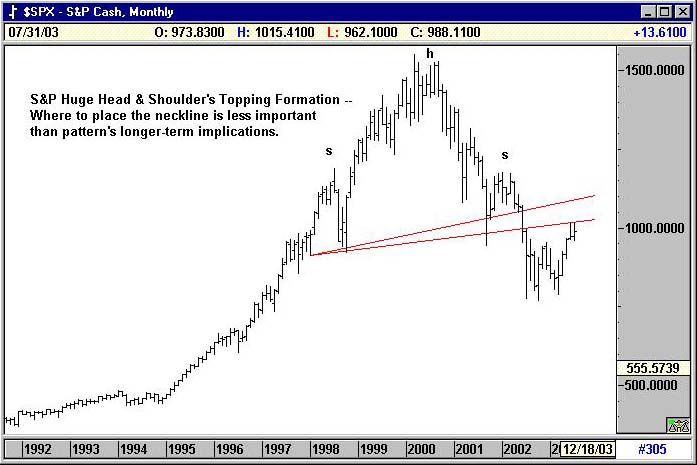

Instead, the market seems tired. It is churning -- one day up, the next day down. But when supposedly good news hits, and the market does not go up the way it should have given the psychological significance assigned to this news by the media, another warning sign exists for a potential downside reversal. On a bigger picture basis, it is important to remember that the market continues to sit just under the neckline of what appears to be a huge Head & Shoulders topping formation on the S&P. Complacency reigns, with some talk of "range trading for the rest of the summer," but as we approach the July 27th PEI cycle date and July 29 Chris Carolyn Lunar Cycle date, we believe complacency is the exactly wrong attitude to hold.

Source: Advanced GET End-of-Day

Meanwhile, the debate continues to rage on whether the U.S. economy faces excessive debt-induced deflation or Fed money-printing inflation. In reality, we likely face some of both. This makes proper macro-positioning in commodity markets and fixed income markets very tricky to negotiate -- as the T-Bond's recent dramatic slide demonstrated to some investors previously enamored with only the deflation hypothetis and Fed-induced positive yield curve carry trades.

Within this general environment, one trade we continue to favor quite strongly is a long gold - short copper spread trade. A full one-third of annual copper production goes directly into home building, and with the cheap money mortgage boom now clearly behind us, surely the chart below of copper (that we have been watching patiently and bearishly for most of this year) will finally break lower in the not-too-distant future.

Source: Advanced GET End-of-Day

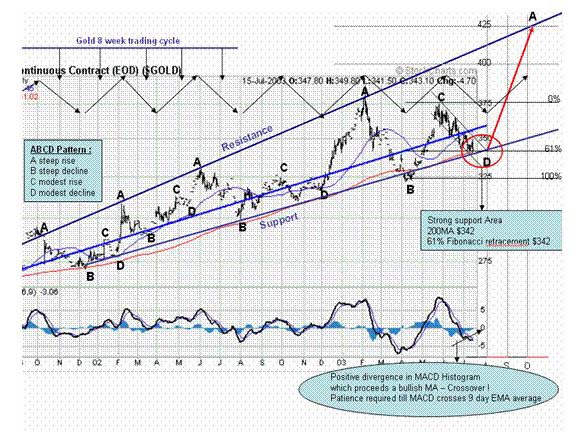

Meanwhile, irritated by our recent lack of commentary on gold and our slightly agnostic view on gold since Spring 2002, one subscriber recently sent us the chart below from a certain Eric Hommelberg. This chart was apparently originally posted at LeMetropoleCafe.Com. It shows a fairly clear recent eight week rhythm to gold and a series of repetitive ascents labeled "A,B,C,D," with Hommelberg suggesting that a new "A" wave is now due for a run up to $425-$435 by October. Is such a move in the cards? We honestly don't know, but it is easily possible.

Certainly if Saddam has any resources left in his arsenal of global Islamic friends, we wouldn't be surprised to see him use them in retribution for the actual death of his two sons. Volcanic activity around the world is also on the rise, perhaps suggesting a looming earthquake of some sort. Hurricane season is also scheduled to be particularly nasty this season. Any number of sudden shocks to the U.S. economy (beyond mere earnings misses) could transpire in the coming days and weeks.

Source: LeMetropoleCafe.com, provided by a subscriber

So hence, the one position we feel particularly drawn to at present continues to be short copper vs. long gold, with a slightly stronger conviction on the short copper portion of this trade. Gold's multi-month up-trendline remains fairly steep, and our years of gold trading still make us suspcious that overly eager gold speculators always stand at risk to get hurt first (perhaps by a false break lower) before reaping upside satisfaction in the long term.

Speaking of the very long-term, the scanned image below is of a 10,000 Reichmark note below issued in Germany in 1922. We recently found a whole pile of them in an old trunk -- undoubtedly left over from some long-past family member's summertime European jaunt. At the time of this bill's initial issuance, it was the largest denominated note in Germany and could buy an entire month's worth of a family's living expenses. For awhile after its issuance, the German stock market was still climbing, supported by newly minted money flowing into it.

But within a few years, this bill was to become known as "the Vampire Note," many believing that the neck of the pictured peasant had two small holes in it -- the life-blood of the German country literally being sucked dry by the Weimar Republic's hyper-inflationary money printing activities. This is the same note that it eventually took a full wheelbarrow of to buy just one loaf of bread.

Perhaps Fed Governor Bernacke should take some heed of this historical experience before continuing to espouse overt use of the printing press as the Fed's ultimate backstop.

Important note to subscribers: Because of the potential significance of the forthcoming July 27-29 cycle window, we will be writing our July subscriber-only article slightly beyond this date, for release on or about August 3rd.

Non-subscribers are invited to access our June 29th article, "The Jig is Up: The Current Market & How Freddie Mac Likely Speculated," together with other past articles, by signing up for a quarterly Sandspring.com subscription below.

How Your Articles Are Delivered

Upon the processing of your credit card or the receipt of a personal check, Sand Spring will e-mail you the articles requested as a Word attachment, and also provide you with a WWW address and password to view the article on the web without using Word should you so desire. Confirmation of your order will be immediate, and the actual article will follow by e-mail typically within a few hours and in all cases before the opening of NYSE trading on the following day.

Ordering by Credit Card:

Our shopping cart is designed for both physical and subscription products, so do not be confused too much when it asks you for a shipping address. A correct address is important only for credit card authorization purposes. Your e-mail information is the most important piece of information to us for proper delivery of your article(s).

Disclosure Statement

Sand Spring Advisors provides information and analysis from sources and using methods it believes reliable, but cannot accept responsibility for any trading losses that may be incurred as a result of our analysis. The opinions expressed are not intended as specific investment advice, and simply represent our personal views offered here under our right of free speech. Sand Spring Advisors is a NFA registered CTA/CPO, but is not a Registered Investment Advisor. We do not directly trade any client funds. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, and should always trade at a position size level well within their financial condition. Principals of Sand Spring Advisors may carry positions in securities or futures discussed, but as a matter of policy will always so disclose this if it is the case, and we will specifically not trade in any described security or futures for a period 5 business days prior to or subsequent to a commentary being released on a given security or futures.

If you order by credit card, your credit card will be billed as "Sand Spring Advisors LLC"

973-829-1962 or by email at the address below:

Take me back to the Sand Spring Home Page

Comments or Problems

Thank you for visiting Sand Spring Advisors LLC, Inc. We hope to hear from you again soon. For more information on Sand Spring Advisors actual programs, services, or to request a copy of a Disclosure Document, please phone us at 973 829 1962, FAX your request to 973 829 1962, or e-mail us at information@Sandspring.com

| Corporate Office: 10 Jenks Road, Morristown, NJ 07960 Phone: 973 829 1962 Facsimile: 973 829 1962 |

Best Experienced with

Click here to start.

The material located on this website is also the copyrighted work of Sand Spring Advisors LLC. No party may copy, distribute or prepare derivative works based on this material in any manner without the expressed permission of Sand Spring Advisors LLC

This page and all contents are Copyright © 2002 by Sand Spring Advisors, LLC, Morristown, NJ